The CESU

(Chèque emploi service universel)

If you wish to keep everything legal when paying casual labour (work around the house, help with homework, private lessons, home help for the disabled and small gardening jobs), and protect yourself in case of injury or accident,why not pay via the ‘cheque emploi’ system? There are several advantages to both employer and employee.

If you wish to keep everything legal when paying casual labour (work around the house, help with homework, private lessons, home help for the disabled and small gardening jobs), and protect yourself in case of injury or accident,why not pay via the ‘cheque emploi’ system? There are several advantages to both employer and employee.

The CESU is a way of declaring and paying for casual labour such as;

• House and garden maintenance (cleaning, ironing…)

• DIY

• Baby-sitting

• Administrative and computing help

• Personal assistance: cooking, driving, walking

• Pet sitting

When you employ somebody at home, regularly or occasionally, the employment declaration can be made easily and quickly on the internet (www.cesu. urssaf.fr) or with Urssaf.

Payment is made via a ‘chequebook’ provided by CNCESU (National Centre of Cheque Emploi Service Universel) or Urssaf.

THERE ARE TWO KINDS OF CESU

1 The “bank Cesu”

A cheque book with bank cheques and special declaration forms (“volet social”) which the employer should send to the CNCESU (national Cesu centre)

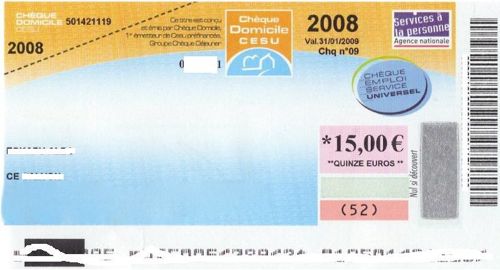

2. The “pre-paid Cesu”

Cheques already made out for a specific amount (similar to luncheon vouchers.)

Fill in the declaration form (obtainable from your bank or online at www.cesu.urssaf.fr), and send it to the Cesu Centre (address below) at the end of each of month. They will work out the contributions, send off a pay slip to the employee, send you a bill and tell you how much will be debited from your account and when.

Alternatively, their website works well and it is easier to make the monthly return on-line than filling in the form. Once the employee is registered there is no need to fill in all the details every time.

ADVANTAGES

• Both employer and employee are legally declared

• The employer benefits from a 50% tax reduction and is insured in case of damage caused by the employee.

. The employee is covered in case of accident or injury, and has a status within the French social security system for pension, unemployment, training……….

• Calculations and direct debit of taxes are organised directly by CNCESU

• CNCESU prints and sends the payslip directly to the employee.

Find out more at www.cesu.urssaf.fr

For more info….

Centre national du Chèque emploi service universel

3, avenue Émile Loubet

42 961 Saint-Étienne cedex 9

N° Indigo 0 820 00 CESU or 0 820 00 23 78 (0,12 € TTC / min)

My name is David Uchenna duru I live in France lyon….I’m looking for cleaner job

My name is maxwell.Am looking for cleaning work in france

Am looking for a cleaning job

I’m looking for a job here cleaning