Tax Timetable

The online service to file your 2023 tax return is NOW OPEN.

Deadlines

The deadlines for online declarations vary depending on the département where you live. For us here in the Pyrénées-Orientales (66), the final deadline is 11.59pm on 6th June 2024.

For readers outside of the 66, here are the other deadlines:

- Départements 01 -19 and non-residents: 11.59pm on 23rd May 2024

- Départements 20 – 54: 11.59pm on 30th May 2024

- Départements 55 – 976: 11.59pm on 6th June 2024

If you are completing a paper tax return, regardless of your place of residence, the deadline is 11.59pm on 21st May 2024.

Do you need to declare?

Anyone in any of the following situations, must complete a tax declaration:

- you live and have your principal professional activity in France

- you turned 18 last year and are not attached to the fiscal residence of your parents

- you live abroad but have income from French sources

How to declare

Online

If you already have a tax number (numéro fiscal), an online access number (numéro d’accès en ligne)and a reference tax income (revenu fiscal de référence), you must file your tax return online.

Follow the steps below:

- log in to your account using your tax number (shown on your last tax assessment) and your password

- select the ‘Accéder à la déclaration en ligne’ button

- fill in the income and expenses categories that apply to you

If you do not have a tax number, you can request one from your tax office in person or via the website: Contact > You are an individual > Your request concerns access to your personal space > I don’t have a tax number.

After completing your 2023 income tax return, you will see the rate of tax that will apply to your income from August 2024. From the end of July, you will receive your 2024 tax notice based on your 2023 tax return. If you notice an error, you can make a correction directly online until mid-December.

Please note

|

Paper

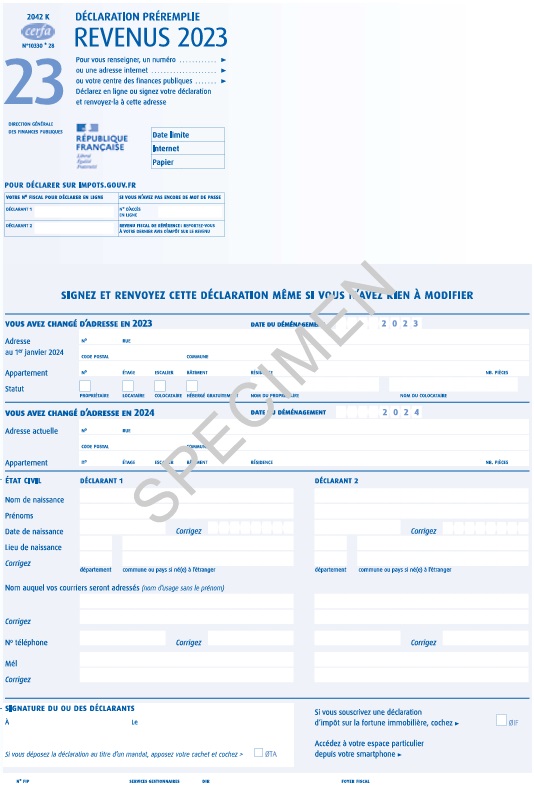

In 2024, a pre-completed 2023 income tax return in paper format will be posted to taxpayers who filed their previous return (2022 income) in the same format (unless you opted not to receive a paper return from 2024).

You will need to check the information given (address, family situation, wages, pensions, benefits, etc.), and correct it if necessary.

You can make a paper declaration if:

- your main residence does not have Internet access

- you live in an area where no mobile service is available

- your main residence does have Internet access, but you are unable to use the online declaration service properly

- you have explicitly stated your wish to receive a paper return

If you do not receive the form by post, or if this is your first tax declaration, you can obtain the form (N° 2042) online (this year’s forms were not yet available at the time of publication) or from your local tax office.

Once you have completed and signed the form, you must send it to the tax office indicated on the form, even if you changed address in 2023. Indicate your new address on the first page of the return.

If you married or entered into a civil partnership (Pacs) in 2023, send your joint tax return (or your separate tax returns) to the tax office of the couple’s place of residence.

New this year

If your personal situation hasn’t changed and if your income is already known to the fiscal services, then your tax declaration should be automatically completed. It will already display the amount of income tax you will be required to pay from September 2024.

If there are no modifications or corrections to be made, you don’t need to do anything! The declaration will be automatically validated on your behalf.

Reminder

Don’t forget, since the discontinuation of the taxe d’habitation, property owners need to declare the addresses and occupancy of all property in France.

If you have not already declared your properties, or if there have been changes in usage, you will be directed to the relevant plateform at the end of your online tax declaration. If you are not declaring income tax online, you will need to declare the properties via your online account. Check out our article here.

Need a helping hand?

Tax declaration can be quite a headache, so if you want expert help in meeting the requirements, and perhaps saving some money along the way, contact one of the tax advisors who support P-O Life.

Taxation Specialists Ltd

Chartered Accountant Flore Saussine

Blevins Franks Tax and Wealth Advisors